Trump Order on Marijuana Rescheduling Doesn’t Cancel State Laws

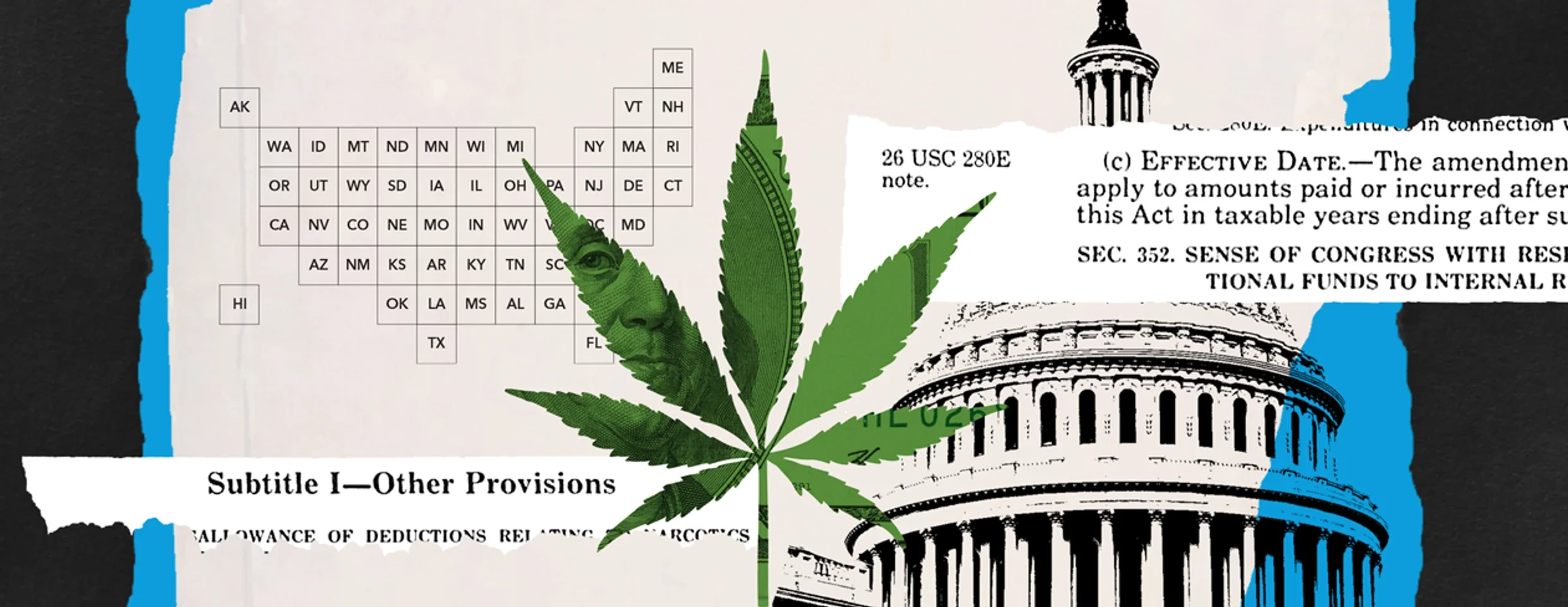

Opinion: President Donald Trump’s executive order to expedite the reclassification of marijuana indicates a decreasing stigma against cannabis and offers the possibility of future tax savings.

Texas Cannabis Groups Need Foresight to Gain Coveted License

Texas applicants for medical cannabis licenses under HB 46 must demonstrate strong financial viability, detailed accounting systems, clear ownership, and a strategic roadmap. Explore what it takes to win one of the nine new vertically-integrated licenses.

Minnesota Cannabis Businesses Can Level Up by Being Efficient

Cannabis accounting experts Abraham Finberg and Simon Menkes say that owners of cannabis companies in Minnesota can hedge against tax-related concerns by using sound business practices.

Why Minnesota Cannabis and Hemp Operators Should Worry More About State and Local Taxes Than IRC 280e

In a major shift, Minnesota no longer conforms to IRC 280e for state income tax purposes. While this is a welcome relief, it doesn’t eliminate the broader tax burden.

How Does Minnesota’s Cannabis Market Compare to California

As cannabis operators consider entry or expansion in Minnesota's cannabis market, understanding how state tax policy impacts your bottom line is critical. Let’s see how it stacks up against another major legal market: California.

Accounting Methods in an Emerging Cannabis Loophole: Part 1

Accounting Methods in an Emerging Cannabis Loophole: Part 1 explores the unique challenges cannabis businesses face when navigating accounting practices.

The High Cost of Getting It Wrong – Why Accurate Financials Are the Lifeline of Every Cannabis Business

Discover why accurate financials are essential for cannabis businesses. Learn how mismanaged books, missed filings, and poor accounting decisions can lead to costly consequences — and how 420 CPA Legacy helps founders build clarity, credibility, and sustainable growth.

Accounting Methods in an Emerging Cannabis Loophole: Part 2

Accounting Methods in an Emerging Cannabis Loophole: Part 2 explores the unique challenges cannabis businesses face when navigating accounting practices.

Small Businesses in America Face a Big Headache: FinCEN’s Corporate Transparency Act Has Arrived

Understanding FinCEN's Corporate Transparency Act (CTA). Essential compliance guidance and strategies for cannabis small businesses facing new reporting rules.

Accounting Methods in an Emerging Cannabis Loophole: Part 3

Accounting Methods in an Emerging Cannabis Loophole: Part 3 explores the unique challenges cannabis businesses face when navigating accounting practices.

Chevron’s End Can Help Cannabis Firms Use Tax Code Favorably

Read our latest blog exploring how Chevron’s End Can Help Cannabis Firms Use Tax Code Favorably

Washington Medical Pot Excise Tax Reprieve Is Good for Patients

Read our latest blog to learn more about how the Washington Medical Pot Excise Tax Reprieve Is Good For Patients.

Cannabis Tax Stacking Harms Legal Sellers and Drives Up Prices

Read our latest blog to discover how Cannabis Tax Stacking Harms Legal Sellers and Drives Up Prices.

Two Cannabis Tax Cases to Watch

Read about two landmark cannabis tax cases challenging Section 280e and the Controlled Substances Act — and what they mean for the industry’s fight for tax relief.

South Dakota Cannabis Tax & the Battle to Approve Adult-Use Sales

South Dakota Cannabis Tax: An analysis of the proposed tax structure and the ongoing legal and political battles to approve adult-use sales.

Navigating Upcoming 1099 Deadlines: Understanding the Purpose of 1099-NEC

Essential guidance on 1099 compliance. Learn the deadlines and requirements for the 1099-NEC (Nonemployee Compensation) to avoid penalties this tax season.

Ohio’s Adult-Use Cannabis Bill Still Needs to Work Out Kinks

Read our latest blog exploring how Ohio’s Adult-Use Cannabis Bill Still Needs to Work Out Kinks.

Unpacking the Impact: CDTFA’s Strain on California’s Cannabis Industry, Recent Developments, and Industry Advocacy

Concerned about cannabis tax compliance and evolving regulations? Get expert analysis, news, and tips from the financial professionals at 420 CPA Legacy.

Navigating Taxes in the Cannabis Industry: A Practical Guide for 2023

Navigating Taxes in the Cannabis Industry: Your practical guide for 2023. Essential strategies for compliance and maximizing profitability this year.

Navigating the Green: Unraveling the Taxing Dilemma in the Cannabis Industry

Expert guidance on the taxing dilemma in the cannabis industry. Learn essential strategies to unravel complex regulations and minimize your tax burden.